The Open RAN product doesn’t seem to be doing very well.

Why do I think so?

I recently came across heavy criticism from the CEO of Mavenir regarding his sales of the product.

What is his problem?

Mavenir invests huge R&D resources in the development of Open Ran technology, and sales are limping.

After reading the post on LinkedIn, I felt scared.

How so? Is such a great advocate and player of the open telecommunications systems market getting ready to capitulate?

Could the President’s confessions mean the end of such a promising revolution among mobile network technology providers?

Fortunately, it was probably just a moment of doubt.

A week later, he posted a post full of optimism and praising the advantages of Mavenir solutions.

This surprising surprise raised a lot of questions in my head.

It fueled deep doubts in me about the future of Open RAN.

I’m sure I’m not the only one with these questions.

When I calmed down, I realized an important fact.

For several years I have been supporting suppliers and operators in the work and implementation of Open RAN into commercial networks, but…

There was always something missing for me when it came to the strategy for this technology.

And suddenly it dawned on me that I felt internal shame why it was so late.

Shame on me for not doing my homework on the basics of product strategy.

I have not analyzed the chances of the Open RAN product in the telecommunications market.

I didn’t create the marketing mix that I did for many other technologies.

Immediately I thought of this as the only correct one in this situation.

I’m sorry, should have been written a few years ago.

So here starts the Open RAN Product marketing plan with AS-IS analysis.

“AS IS” analysis for Open RAN product

The best way to perform analyses is to use proven tools.

I will use the classics because it has to be simple and direct😊.

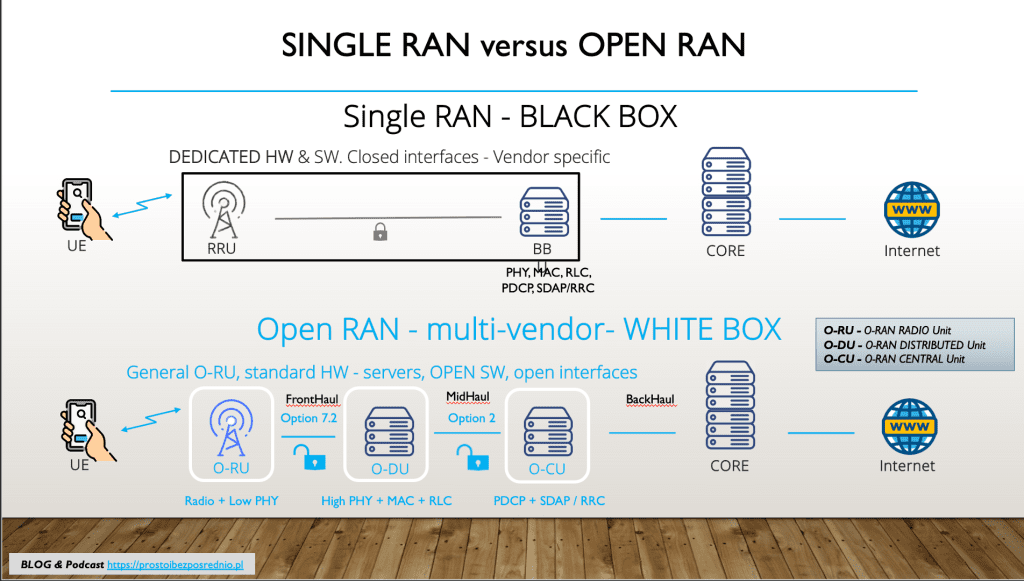

At the beginning, let me just remind you what is the main difference between the world of Single RAN and Open RAN.

In the case of a Single RAN supplier, all components of the radio solution come from a single supplier.

In the case of an Open RAN solution, thanks to the separation of radio protocol layers, individual components can come from different suppliers.

This key difference means that in the case of an Open RAN Product, we can talk about one or more sub-suppliers of one base station.

This is one of the key elements of the analysis below.

To begin with, I assume that every solution case is theoretically possible.

Is it practical?

This will become clear during the analysis.

I will write a lot about the specific aspects of such a multi-vendor solution.

Porter’s Five Forces for the Open RAN Product Environment

First, I did a 5P analysis to understand the environment in which potential Open RAN providers must operate.

Internal competition

The market for Open RAN manufacturers and suppliers is itself very competitive.

This development is facilitated by the creation of Open RAN an open standards.

The widespread methodology of creating software based on open-source sources has also become indispensable and helpful.

The entry barrier for producers of even a “piece” of telecommunications technology has decreased significantly.

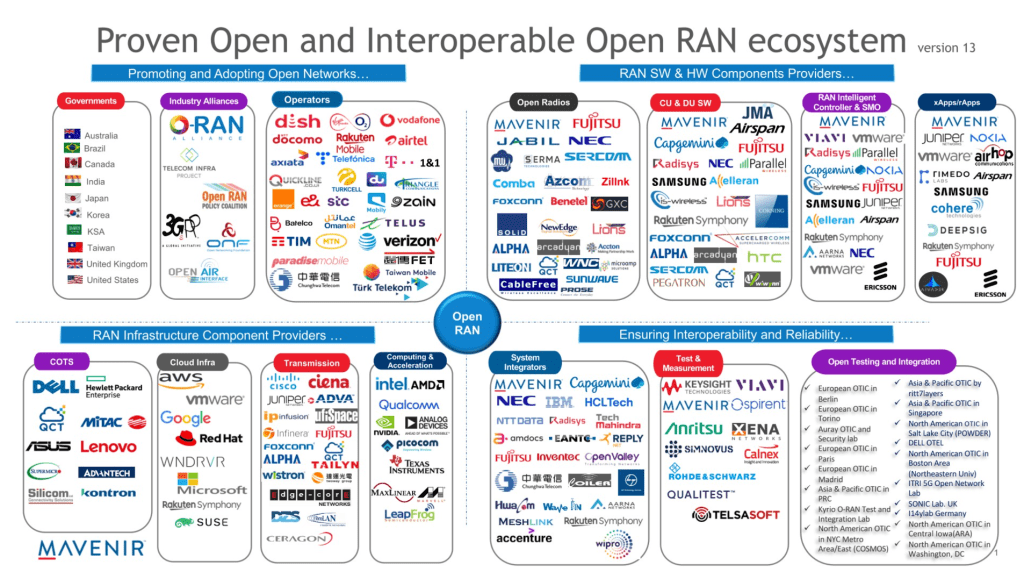

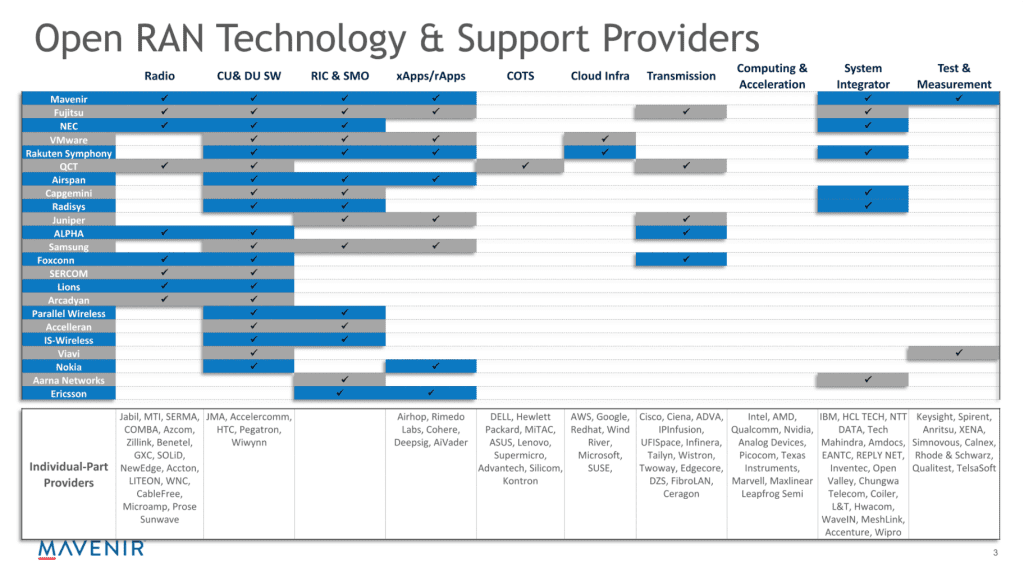

Recently, Mavenir, on its initiative, presented a map of competitors and cooperating companies (more on this later).

The competitor map looks impressive.

I can add that while working for an Open RAN provider, I got to know many more companies.

This just shows that the competition is much greater and can grow, although I believe it should be the other way around.

Especially many companies appear in India, China, and the USA.

Internal competition is also growing from the SCF (Single Cell Forum) organization.

SCF offers a similar product, based on the much simpler-to-use split 6.

This competitor has a chance to capture the large market of small indoor networks and private networks.

Single RAN providers also have internal competition because they are also working on Open RAN.

Current Single RAN providers are not giving up (Ericsson, Huawei, Nokia, ZTE).

First, they are active participants and innovators of the Open RAN forum.

Secondly, knowing the advantages of Open RAN, they started to come up with Single RAN products that reduce the advantages of Open RAN.

They want to persuade customers to stick with their products by offering something in between.

This approach is a great start to point two of the 5P analysis.

Substitutes

Single RAN vendors have already started coming up with Open RAN-like products, mainly in terms of the RIC platform (intelligent algorithm development).

In addition, they are working intensively on implementing automation of various ML and Gen AI algorithms.

It is easier to convince an existing Single RAN customer that the current product can be modified and upgraded than to be completely replaced.

This helps to save already incurred network construction costs.

Applies mainly to large MNO networks.

What about small indoor networks and private networks?

This is an important element of the analysis because the private network market is growing very much and is a tasty morsel for all providers.

As I mentioned above, SCF and Single RAN solutions can be a substitute for Open RAN.

I have seen SCF solutions for small in-building networks and I am convinced that they will capture a large share of the market.

SCF solutions will be quite cheap because radio chip suppliers (Qualcomm, Marvell, etc.) offer ready-made network products based on split 6.

Single RAN suppliers also prepare special solutions for private networks based on smaller base stations with lower transmitting power.

Alternatively, WiFi6 and WiFi7 solutions can be used for small networks, mainly industrial ones. The development of WiFi standards dictated by mobile network manufacturers has given this technology a second chance to take over the industrial market.

Smaller, but also a substitute.

I was once asked by a client why not build a cheaper WiFi network.

The next element of the analysis will be the power of customers.

Purchaser power

Why is the market pushing to create a new RAN supplier from a buyer’s perspective?

One of the biggest sins of Single RAN providers has been dominating the market.

Domination in the price area and product development in the direction set by suppliers.

It has been known for many years that mobile networks can be built more effectively.

The use of very expensive and limited cellular bands can be better managed.

Single RAN vendors are successfully defending this stronghold.

And this is the answer to why operators and new suppliers have organized to create something new, something tailored to their needs.

The power of buyers has become a driving force for change and hope for something different.

According to the assumptions of the Open RAN association, the customer has a very large impact on how the Open RAN product will develop.

The buyer has an influence on the roadmap to an extent that is important to him, not only the apparent benefits.

Of course, nothing in life comes easily and cheaply.

New technology, especially one that has changed so much compared to the known ones, requires your effort.

The customer can and should actively participate in product development.

This will allow him to better understand the benefits and train and implement his staff.

This is a very difficult and expensive part of the game, but it is this power that allows customers to have influence.

In this case, I have a very interesting memory from the 1990s, when I participated in the testing and acceptance of new versions of Ericsson, Siemens, and Nokia products.

These were the times when these companies’ software was falling on the Internet like houses of cards.

Yes, large vendors also followed the path that Open RAN vendors follow today.

Everything was going wrong and a lot of work had to be done on the programming and testing processes.

It was difficult, but it allowed us to have an impact.

The practical impact, not just apparent.

This is what operators want.

They want to influence the product and create something unique, competitive, and, above all, cost-effective.

I will come back to this later in the plan.

Meanwhile, let’s look at the power of suppliers.

Vendor’s power

I’ll start with Single RAN vendors.

These are the biggest players on the market and have the most cards from the deck in their hands.

Each supplier has a huge base of existing customers.

Each of these players is constantly actively trying to steal each other’s customers.

This strength, the customer base, is the real advantage and the biggest advantage over potential Open RAN providers.

The second strength of Single RAN providers is their participation and operation in standardization bodies ETSI, 3GPP, etc.

Customers like to have proven, reliable solutions that maintain the quality of the product and, consequently, the services offered.

Compliance with standards provides customers with such foundations.

Therefore, standard creation is largely mastered by Single RAN vendors.

Please remember that this is not only their strength but also their weakness.

Because creating standards requires a huge expenditure on R&D.

Moreover, standards have been accumulating for many years and include more and more technologically unnecessary elements.

Thanks to this, it turns out that simple Open RAN solutions may turn out to be more effective in terms of performance and processor resource needs.

Another strength of Single RAN vendors is the lack of X2 interface compatibility between vendors.

This is a very sad thread.

The X2 interface was intended to allow operators to mix radio networks from different suppliers.

The standards have been developed and established, but not implemented.

All in all, I would venture that the barrier became an important seed for the emergence of alternatives to Single RAN.

The final strength of Single RAN providers, significant but overlooked by the Open RAN product, is the ability to implement and maintain/develop the product.

I will write more about this element of the Open RAN Product in the 7P analysis.

Single RAN vendors have learned that other aspects of the product than just technology are also important.

This must not be omitted, otherwise… bench.

So can new players somehow overcome the barriers and have a piece of the cake?

Of course.

Let’s look at the strength of the new players.

New entrance power

We already know why the market wants new solutions.

I will analyze whether these factors may be sufficient to enter the market.

Firstly, it’s about gaining influence and reducing the dominance of existing Single RAN players.

This should ultimately improve the efficiency of mobile networks and reduce the costs of providing services.

Secondly, a powerful force was created.

The power of cooperation between many (hundreds, thousands) of engineers who want to implement more flexible and optimal RAN solutions.

Lots of companies specializing in elements of telecommunications algorithms want to create products.

Moreover, most of these companies have no problem cooperating and supporting each other.

Just look at the effects of the activities of the TIP laboratories or the Open RAN forum.

It’s easy to see how many companies are making a concerted effort.

Whether these are efforts aimed at success is another matter, but I will discuss this with the SWOT tool.

Third, and in my opinion most important, the Open RAN standard introduces the RIC platform.

This is definitely the greatest value of the entire solution.

RIC enables you to change the way you manage network efficiency.

This is a place where magic can happen, at many levels of the process of maintaining and developing mobile networks.

This is such an important and innovative solution that even Single RAN suppliers have started to partially implement it in Single RAN networks (rApps in O&M systems).

The last force I mentioned here is the powerful network of huge OEM and ODM manufacturers from Taiwan, and China and slowly emerging in India.

OEM and ODM companies such as KMW and Comba produce, in cooperation with others, wholesale quantities of O-RU radio devices.

These companies count on large sales and do not limit their range of clients to one company.

They are open to cooperation with various clients.

The collaboration process is quite simple.

NDA, product specification, showing the potential of customers, and you can sign the contract and wait for the “containerization” of the solution.

ATTENTION! Containerization is another method of measuring the size of the project measured by the number of delivered containers of radio devices 🤣. Not to be confused with software architecture😊

This model of product creation is one of the basis of the activities of Open RAN software companies.

As you can see, there are many forces for the entry of a new player.

Nothing to do but create a technological product and sell it, right?

Oh, no, not so fast.

This is exactly what many creators and technology producers thought and probably still think.

With a little patience, wait for chapter 7P, and you will see that the mistake in the approach to selling the Open RAN Product so far was made elsewhere.

Before I reveal this tab, I will delve a little deeper into the strengths and weaknesses of the Open RAN Product.

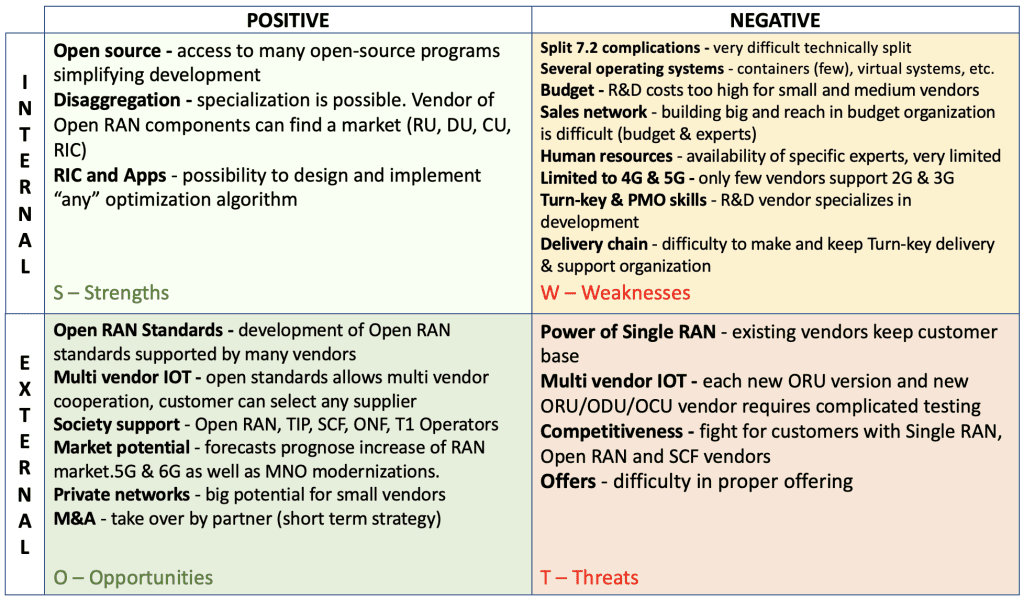

SWOT of the Open RAN product

I move on to the second point of the AS-IS analysis, where will use most managers’ favorite tool, SWOT analysis.

I prepared a SWOT matrix based on my experience as an Open RAN supplier and potential customers from several Open RAN tenders.

Strengths. Positive sides, internal

“There are advantages, there are advantages.

Who wants the product, who will give more?”

The power of open-source solutions

Modern programming allows us to develop products that we have never dreamed of even faster.

Well, maybe apart from Stanisław Lem?

The IT world is very open and good-natured.

The IT world loves to share its products in the form of “Open source ” sources and methods.

As you can see, not only money but also glory can be a motivation for talented people.

That’s great because all telecommunications standards have adopted this idea.

You no longer need to know magical programming languages created for telecommunications device manufacturers.

Many well-developed programming languages and methodologies can be used.

Using open interfaces, Open API methods, or adapting libraries.

A good team of programmers supported by telecommunications protocol engineers can create a product.

This is a huge change for the telecommunications market.

Single RAN Vendor Lock-down Breakdown.

Disaggregation

The idea of breaking down the radio protocol into RU-DU-CU elements is due to the 3GPP standards.

The division into radio protocol layers and their separation makes it possible to look deep into radio systems and create digital products (e.g., Network Functions), not only the creation of closed, physical processors.

Disaggregation allowed for better manipulation of the telecommunications protocol.

New, different algorithms and impact on the entire telecommunications protocol chain.

The Open RAN standard is based on split version 7.2, which is of particular importance for the development of the RIC platform.

Breaking away from the Single RAN solution, which is like a closed armored box with input and output.

It also allowed the use of many different, modern, and effective programming techniques.

It is also fully adaptable to modern container and virtual environments.

Thanks to this, it allows for the rapid production and development of systems in DevOps processes, etc.

Additionally, it is easy to scale.

Another advantage is easy (theoretically) portability between different operating environments.

This portability thing is a little more difficult, but it is a challenge to overcome.

Why?

If the manufacturer chooses a programming environment, e.g., RedHAT, it must be taken into account that the customer may have a different standard.

Diversity of environments requires onboarding.

Be open for onboarding.

You can’t say containers like that, but only in our understanding.

RIC and Apps

The RIC platform and XApps and rApps are “cream of the crop ala cream” by Open RAN.

If you want to be an Open RAN provider and do not intend to work on RIC applications, at least be 100% sure that you will support your partners in this area.

This is by far the greatest value of the Open RAN Product.

A lot is going on in this regard.

RIC is a definite game-changer.

The magic of creating and changing algorithms for the needs of each client?

Why not.

No other technology offers this today.

Even Single RAN.

I don’t think I need to praise and encourage more.

Weaknesses. Negative sides, internal

Split 7.2. Complicated technology

Someone once told me that deciding to choose a 7.2 split is a very big mistake.

The PHY layer was torn in the middle and connected by a transmission located kilometers away.

This poses the most difficulties in Open RAN development, apart from the advantages of the RIC platform.

Further consequences?

The more demanding the radio module is (e.g. number of MIMO antennas, radio bandwidth), the more complicated the cooperation between the Low PHY and High PHY layers.

Creating a simple radio module, e.g. MIMO 2×2, is not the same effort as the Massive Mimo 32T32R module.

That’s the first thing.

Secondly, as happens in life, Open RAN vendors have made life complicated for themselves.

Namely, several independent Software KIT solutions have been created and used to implement Open RAN radio layers.

Intel has developed Intel Flex RAN, Qualcomm has its solution, and many other independent implementations have been developed.

Ideally, the Open RAN base station manufacturer uses the O-RU radio module and O-DU software from a single manufacturer.

This is the best, but it is not an ideal case, because it is not real life.

Not every manufacturer of O-RU radio modules offers products for every band and frequency.

This is simply too expensive an approach.

As a result, the end supplier must cooperate with various O-RU suppliers and perform breakneckly expensive and difficult integrations between O-RU and O-DU components.

In my opinion, until the testing and patching of software on this interface is fully automated, the Open RAN Product will have a lot of problems.

For now, this is one of the biggest weaknesses of the solution.

Various operating and cloud environments

Every supplier likes to walk in their own shoes.

Each lead programmer has his own opinion and preferences regarding the language, environment, and data processing.

And that’s great.

However, what a programmer likes cannot become a customer’s nightmare.

Otherwise, there will be no difference between a Single RAN and an Open RAN provider.

As I wrote from the beginning, remember that onboarding for various environments must be possible.

Whether it’s a local cloud or AWS, AZURE, you need to be prepared and have experience in implementation.

Of course, this increases costs, but it has to work that way.

The premise is very important.

The operator, the client must decide on what basis the cloud should operate.

If the whole idea is to work, the client should have a universal cloud and applications from various suppliers that will work together EFFECTIVELY on it.

Otherwise, the idea of an open system will fail.

Lockdown will be back again but with a new face.

R&D budget

This is a non-trivial problem. Work on complex, new technologies such as active antennas requires R&D and many tests.

It is not enough to develop the technology theoretically, it must be verified.

This involves high costs and, of course, takes time.

Small companies working on an Open RAN product, e.g. O-CU software, perform simulations in the laboratory and conduct tests there.

Such companies take a risk by offering a partially tested solution.

In practice, however, many unknowns may be encountered in the real environment.

This comes with frustration during IOT integration or testing.

It takes a lot of effort.

The circle closes.

Investors want to reduce development costs and see sales revenues as quickly as possible.

However, you cannot make money on a poor-quality product. True?

Distribution network

Sales network for an Open RAN manufacturer?

It would seem that it is completely inappropriate to analyze such an aspect of the supplier’s activity.

Nothing could be further from the truth.

A product with a capital P is not just a device or software.

This is the whole thing, including processes and the sales network.

Unfortunately, the truth is brutal. Even the best product without a seller is only the best product.

Many Open RAN vendors do not have experienced salespeople.

When it comes to the MNO market, we are talking about a powerful industry dominated by masters of patient Single RAN sales.

Selling base stations to a network operator is a process that may take many months or even many years.

Let’s remember that time is money, and when it comes to the sales process, it’s not a small amount of money either.

I will describe these issues in more detail in the strategy section.

Limited to 4G and 5G technologies

It may not apply to all providers, but it is definitely a problem for most creators.

Every new Open RAN vendor starts with the most lucrative band, C-band 5G.

This makes sense because operators will acquire this band and will have to build 5G networks for this band.

The problem is that operators are thinking differently about adopting Open RAN.

They try to start the tests with something they know and have mastered.

Operators want 4G and even 3G and 2G solutions.

When we think about switching to an MNO that today provides all versions of the cellular network, a provider that only offers 5G and maybe 4G doesn’t fit the puzzle.

This is the case with most Open RAN vendors.

In this matter, providers, on the other hand, can count on private networks, which are usually limited to the 4G and 5G bands.

Private networks, however, are not the same piece of the pie.

The process of operators moving away from 3G and partially 2G bands gives some hope.

However, it will take a few more years.

Human resources

Until recently, there were 3-4 Single RAN vendors and 3 first-wave Open RAN vendors on the market. That’s what we used to call it (Mavenir, Parallel Wireless).

Currently, several dozen companies with ambitions to become suppliers have appeared on the market.

This company development requires extraordinary experts.

Open RAN technology will also generate demand for scientists, not only engineers.

Creating a good, optimal RIC algorithm is a task for people with comprehensive knowledge of radio wave propagation, mathematicians, and, of course, practitioners.

This is the first side of the cube.

The need for programmers, data engineers, testers, etc. is growing.

All focused on knowledge about mobile telecommunications.

The next side of the cube is the team to handle IOT tests between suppliers or tests with operators.

You also need a good team of experts in O&M processes and systems.

I was shocked when Tareq from Rakuten Mobile boasted on LI that after 2 years he had found the right man to lead the O&M team.

Technology based on many modern solutions (cloudification, open source, IT programming, modern data engineering, AIOps) requires extensive education and experience.

Such personnel have been acquiring and training for years.

Coming back to sales, I would add that sellers also need to be found.

Experienced sellers.

Implementation processes, PMO, Turn-key support, and delivery processes

Creating a product is just a step.

The next stage is the implementation process and finally the longest and most important maintenance process.

The customer expects a methodology and implementation quality similar to that of Single RAN providers.

The latter have been building and training their organizations for this purpose for years.

They built organizations on at least two levels.

Global and local.

The implementation of 2,000 base stations may take several years.

For this, you need to have a local organization that knows best the realities of the market.

In turn, to coordinate production and logistics between several clients in several countries on several continents, you need to have clever organization at the headquarters.

When you are the proud producer of the first prototype of your open RAN product, think about how far you still have to satisfy a demanding customer.

An Open RAN provider should not think like an off-the-shelf product provider.

He has to think about the entire process from A to Z.

Does he have to do it himself?

No, but he must be fully aware of this from the very beginning.

There are many, many Weaknesses.

And believe me, I didn’t see some of it at first either, when I helped create the Open RAN product.

Does this mean that a small manufacturer of 5G indoor base stations has nothing to look for in the big world?

Of course, he does.

The beauty of this environment lies in the area of interoperability.

A good product is an opportunity.

Opportunity for an Open RAN Product.

Opportunities. Positive sides, external

It’s time to evaluate the product’s greatest opportunities.

Open standards

This is the most powerful weapon of this technology.

Open standards that a huge number of organizations are working on to create and develop.

Someone will say yes, but 3GPP standards are also open.

It seems so, but the difference is who dictates the content of these standards.

ETSI and 3GPP have been dominated by ideas and solutions from well-established suppliers for years.

In the case of Open RAN, everyone is invited to the table and they work with the assumption that openness should apply to all elements of the standard.

Also, algorithms that can be redefined.

True interoperability collaboration (IOT)

The openness of cooperation and the willingness of many suppliers to act means that everyone wants and needs to cooperate with each other.

I mentioned the X2 interface from the 3GPP solution.

It is supposedly open, but its compatibility is not ensured between Single RAN providers.

In the case of Open RAN, the situation is different.

Dividing the radio protocol stack and using split 7.2 forced the need for cooperation between different companies.

There is more happening in the realm of software, which by its nature requires interfaces and compatibility.

The creators of Open RAN hope to achieve an effect similar to the historic opening of Android and IOS operating systems to external suppliers.

In the world of mobile phones, everything works together, and so does Open RAN.

Support environments

Another powerful force is environmental support.

Many organizations: TIP (founded, among others, by Facebook) bringing together several hundred companies, the Open RAN forum, SCF (Small Cell Forum), ONF (Open Network Foundation), and many others.

They promote, help organize IOT testing laboratories and organize joint conferences (e.g. Fyuz).

Significant support is also provided by leading T1 mobile operators such as Orange, T-Mobile, Telefonica, and Vodafone.

They are the biggest promoters and testers in the environment of operators, the largest clients.

I saw for myself that this cooperation worked in 2019 at one of the first TIP meetings in Amsterdam.

I had the opportunity to talk to many companies and it was not a problem to reach people such as the CTO of Rakuten Mobile, the head of TIP, or representatives of Intel.

Each of these people was open to helping a small supplier with the ambition to become part of this world.

Market potential and private networks

The market of MNO mobile operators is quite a closed set.

Few new operators are emerging.

Every operator, however, must in the process of his life:

- Modernize the mobile network

- Implement new solutions, e.g. new bands or new generations of 5G or 6G

- Replace an existing supplier for some reason.

This is the scope of the Brown Field solutions market.

An incredibly difficult market.

Of course, there is also the need to create a new operator:

- Single new networks in some countries (regulator’s decision, bankruptcy, or resale by previous operators in a state of unfinished implementation)

- Building a private network.

This is a Green Field case, ideal and attractive for an Open RAN provider.

The greatest potential comes from the exploding need to build small private mobile networks.

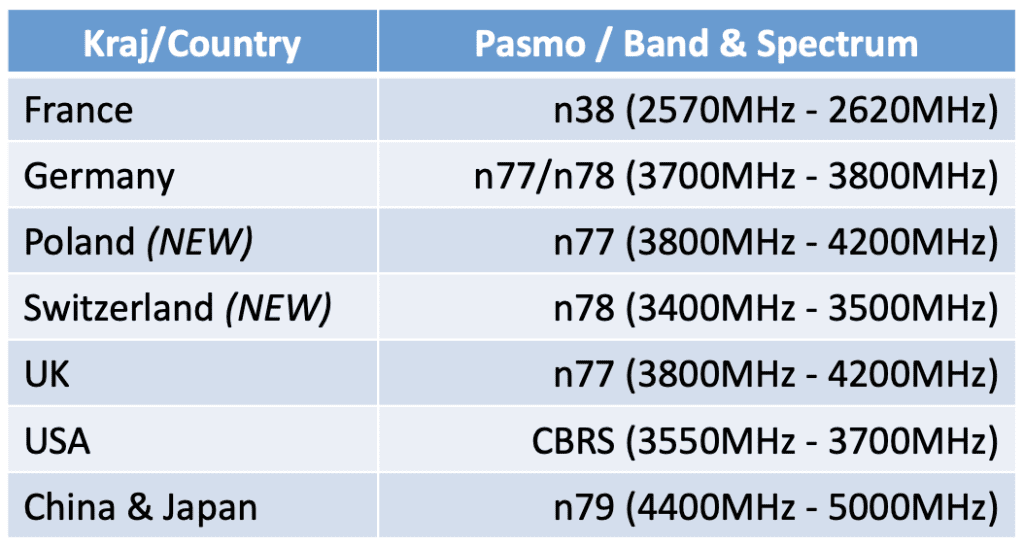

An increasing number of national regulators around the world are deciding to make private bands available.

Germany, the UK, the USA, and currently Switzerland are the best examples of this.

This opens up many opportunities for suppliers.

Medium-term (GF) and long-term (BF) potential is a good prognosticator.

Sales managers have something to focus on.

Takeovers and acquisitions

For some companies, especially smaller ones, there is another chance.

In the M&A process, they can become part of a larger company and increase the chances of developing their unique technology.

By the way, they predict that this will naturally be the next stage that has already slowly begun.

Finally, let’s analyze the threats because as we have seen for several years, things are not as rosy as expected.

Threats. Negative sides, external

The power of Single RAN companies

He is a powerful and very strong opponent.

This is an opponent you need to admire, imitate and, of course, take as much of the cake out of his hands as possible.

Single RAN providers are playing on two fronts. On the one hand, they create their solutions, let’s call them 3GPP solutions.

On the other hand, they are active on the Open RAN forum.

They help create standards and bring a lot of knowledge and experience.

The key question, however, is what they want to do with all this.

Nokia offers Open RAN, based only on its components.

The exception is the collaboration with Rakuten Mobile, where Nokia has supplied thousands of radio modules.

Nokia has also prepared a hardwired module for Open RAN base stations, which will work with other O-RU manufacturers.

Ericsson initially claimed that it would do this when 6G technology comes in, as this is the right time according to them.

Now, it has announced that it wants to lead the launch of Open RAN from 2024 onwards on the basis of its radio products.

Huawei is silent and pretends that nothing is happening.

As much as I know Huawei, it’s completely the opposite, but time will tell.

Either way, the first concrete indications are beginning to emerge that these suppliers are starting to close their product ranks.

They want the power of Open RAN to decline.

For example, the previously mentioned own products based on ML and AI.

This will make it difficult to maintain the advantage of RIC solutions if customers get a good substitute.

To summarize this point.

The Single RAN competition is strong and increasingly wants to escape its competitors.

Interoperability cooperation tests between suppliers

As I have already written, the effort of interoperability testing is one of the greatest difficulties.

For several years, I have been observing the efforts of companies and organizations to automate and improve this process.

This is not a simple topic:

- Multiple standards of Low HIGH and High PHY protocol providers.

- Development of increasingly complex radio systems: MIMO, Massive MIMO.

- Modernization of existing O-RU product families

- New software functionalities requiring repeated testing

- Changes to Open RAN standards. Functionalities and management interface (M).

Unfortunately, this will not end, although it will become less burdensome over time.

You simply have to go through this stage of technology development with gritted teeth.

This will take several years and will slow down rapid implementation projects.

Why do I think so?

I will keep your spirits up.

Many of you, including myself, spent many hours in basements doing the same tests with Single RAN technology.

And everything ended well.

Single RAN vendors delivered.

Open RAN vendors can do it too.

Patience.

Competition, or how to implement coopetition in a healthy way

We come to another threat.

Internal competition between Open RAN providers.

Today, everyone, maybe most, works together.

But tomorrow, when the market for Open RAN Product providers stabilizes, they will start competing with each other.

The Lord of the Flies dilemma.

It is worth preparing for this next step today.

In my opinion, this issue will be partially resolved by the upcoming M&A acquisitions.

But then the Open RAN Giants will have to find a way to have good coopetition.

Otherwise, customers will again end up in the same place as today with Single RAN providers.

They will have to “fight with suppliers”.

Cooperation must be developed and maintained.

Offering

Can the product sell itself?

Of course not.

You need to be able to make an offer and be competitive.

If not competitive, then at least ATTRACTIVE to the customer.

In the following sections, I will discuss the required components of a 7P product.

In the meantime, I will write what is currently available in the Open RAN Product offers.

For new suppliers, I try to place offers at the level of offers from Single RAN suppliers.

It makes sense, because why should you value yourself lower than your competitors?

The problem is that there is more to value than just the product itself and its development.

You need to add a few additional elements to the valuation and then prepare the quote.

I give details in the next chapter.

It cannot be assumed that the first customer will repay all costs incurred.

This may be a naive assessment, but this is the impression I get when looking at offers in the last two years.

It is worth having a 10-year business plan.

Is 10 years a long time?

Absolutely not. That’s a good assumption.

If Open RAN Product providers do not learn this lesson, they will have nothing to look for in the Brown Field market.

Brutal assessment, I know.

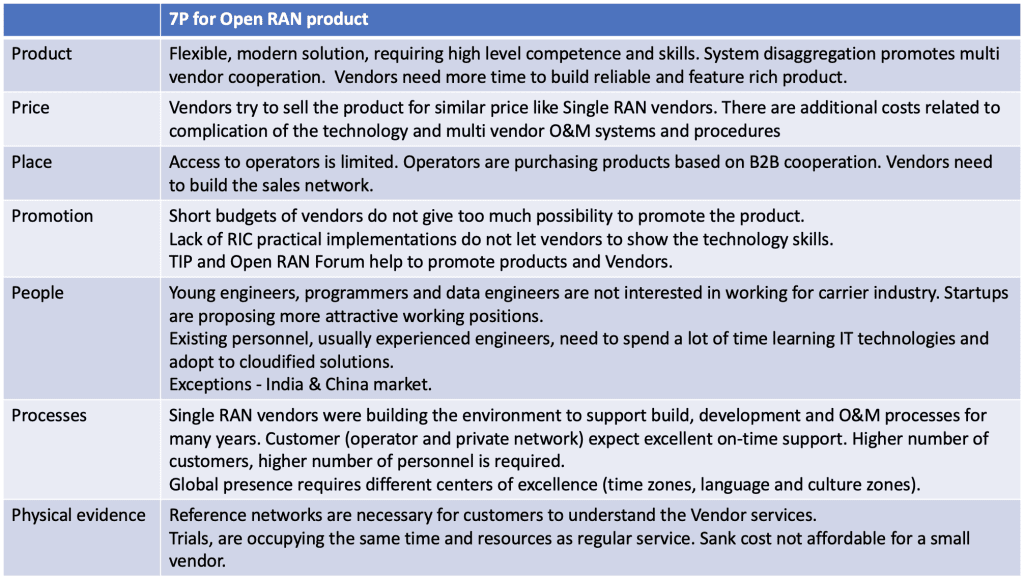

I will now move on to discuss the sales power of a product based on Edmund Jerome McCarthy’s next best tool, the 4P composition.

Instead of the basic version of 4P (Product, Price, Place, Promotion), I will use the extended version of 7P (about People, Process, Physical evidence).

Definitely, the extended model will better help understand the differences (GAP) between the offers of Single RAN and Open RAN providers.

Marketing mix – 7P, not 4P, which is extremely important for Open RAN product

The 7P is a great fit to complete the AS-IS analysis.

After creating it, I opened my eyes to a few aspects that were overlooked.

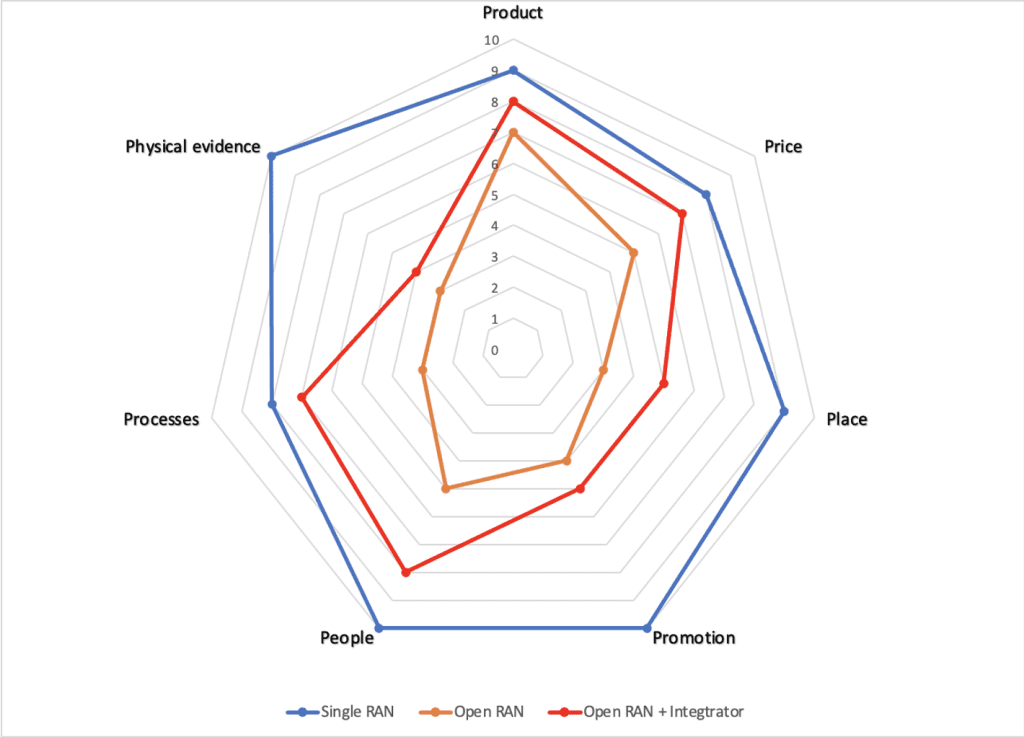

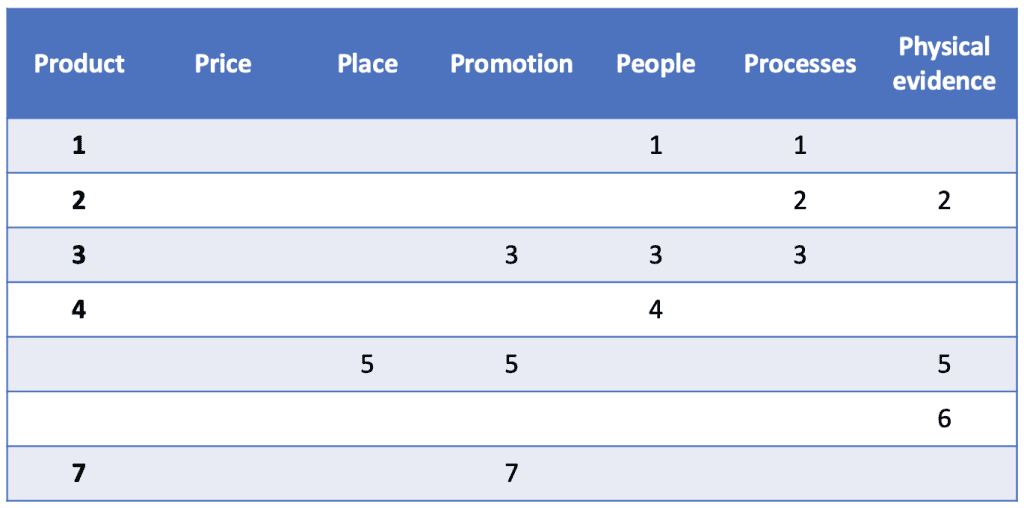

To better illustrate the importance of the 7Ps, I made a chart showing the strength distribution of the products.

I used a scale of 1 to 10 points, with 10 being the highest score.

Please take into account that this is of course my opinion.

Even if I didn’t define the individual points “right”, this chart shows the differences (GAP) well.

Never mind the exact difference, of course.

The most important thing is that we realize that there is a difference and understand that apart from technology, other aspects of the offer are also important.

In the chart, I compared Single RAN, Open RAN, and Open RAN in cooperation with an integrator.

Why with an integrator, the next chapters will reveal it.

How do I justify this assessment?

Product

“By his clothes, you will recognize him.”

Open RAN providers are largely at the beginning of building a good quality, reliable, and functional product.

This process simply takes time and costs money.

The standards are constantly being developed, but are in a fairly basic version in many areas.

For example, standards regarding management functions are the last to develop because they must be built based on base functions.

Management systems are created for the O-RU radio module product.

O-DU and O-CU providers have their management systems and protocols.

The end customer wants to have a single management system that oversees the entire product chain under uniform O&M processes.

In my opinion, the Open RAN product requires another 2-3 years of stabilization to be compared in its scope even with Single RAN.

Price

I have already written about price in connection with SWOT and Porter’s 5 forces.

This issue is best summarized by the chart above.

The price of the Open RAN Product is close to the price of the Single RAN Product, while it does not cover many aspects of the offer such as services and processes.

It also offers a less mature product (features, quality, maintenance aspects).

There will also be a huge cost hidden under the guise of changes that the operator must make in his organization.

Salaries

How can you become a mobile operator supplier?

You have to take part in the tender.

Of course, you must know about this tender and be invited.

Ha, quite a problem.

Today there are 4 Single RAN vendors and about 30-50? Open RAN Providers.

How many suppliers can the operator invite to the tender?

7-10?

This is probably the maximum, if not too much.

Participating in tenders is relatively simple.

A few sellers can conduct a larger number of tenders, participate in a video call, or go to a meeting.

But this business is based on everyday B2B contacts.

Each Single RAN provider has a dedicated sales team in each country, separate from each operator.

Such a network is a powerful tool for the supplier.

Ears and eyes need the first line of resistance in case of any problems.

Unfortunately, this is again a gigantic cost, measured in millions of USD on a global scale.

You only need to look at the direct cost lines of companies such as Huawei or Nokia to understand how much resources it consumes.

I will add one more aspect to this.

Reference visits to suppliers.

This is extremely important, especially in terms of the supplier’s influence on the operator’s management board.

A trip to the supplier’s central office builds a very strong bond through:

- Showing first-hand how solutions work

- Presenting the product roadmap and product development strategy

- Management board meetings with key people in the organization. Shortening relationships between decision-makers

- Creating the impression of influencing the supplier’s activities.

You could write a PhD on this topic on how perfect sales activities are conducted by Single RAN suppliers.

A strong, but again, expensive initiative.

Sooner or later every supplier has to decorate themselves with such feathers.

Promotion

Like sales, product promotion requires a marketing network.

Open RAN providers cannot spend much money for this purpose today.

If they have no income, it is difficult to invest in promotion.

All organizations around Open RAN are here to help.

Technology forums and platforms such as LinkedIn are of great help,

However, this does not change the fact that this message reaches people who are interested in the topic, but not necessarily decision-makers.

Many of the promotional techniques can easily be borrowed from Single RAN providers.

This area will only work when the sales network is developed.

The promotion itself without access to B2B sales makes no sense at all.

It becomes just a general PR exercise that only works for a short while.

People

Open RAN vendors have, for now, small teams mainly focused on product development.

There is a need to expand other areas of human resources.

We are talking about operational resources.

Conducting trials, implementations, problem-solving, maintenance, software upgrades, support for cloud solutions, etc.

It’s a whole team of people and it would be best if they were local, or at least continentally local, bands.

There is another important aspect of contact with the supplier’s employees.

Marketing aspect.

Each employee is also a promoter and advocate of the product.

In addition to his work, he also provides knowledge inside the client’s organization.

Remote calls severely limit this function.

In this area, we cannot forget about the people on the operator’s side.

Open RAN technology brings the need to acquire new skills on the client side.

The supplier can and should even help the operator in this task.

Processes

A supplier’s honor of becoming a customer of a mobile operator is just the beginning of the delivery process.

The sales process itself is a very thankless stage.

I know from experience that the process of selecting or replacing (SWAP) a supplier can take up to several years.

The minimum, I would venture, is 6-9 months.

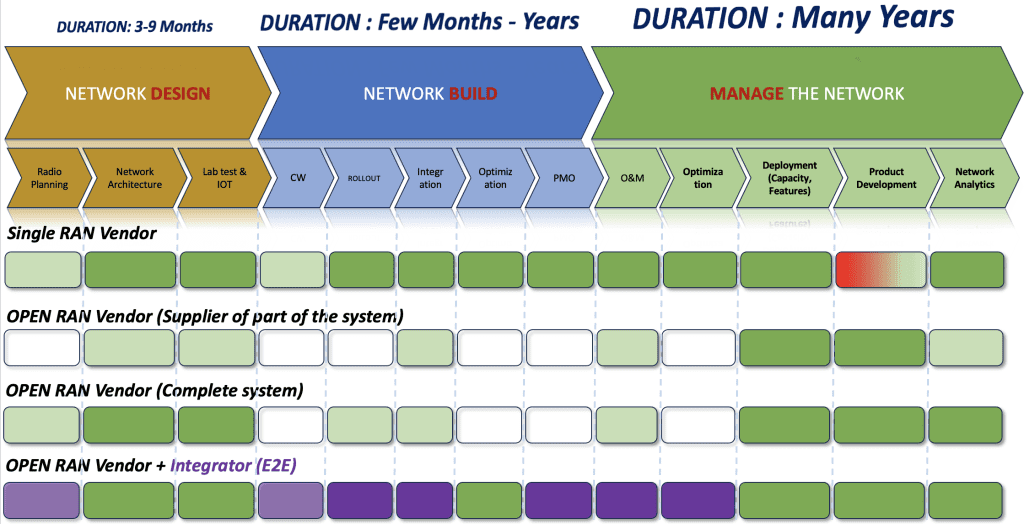

There are phases after the sale:

- Creating a network architecture (Network Design). 3-9 months

- Building a network/helping the operator in construction (Network Build). From months to years

- Network management and maintenance (Manage the network). Many years to come, hopefully.

For each stage, you need to have simple and mastered processes.

With one client, for example, your first client, you can improvise.

With many, you need to have processes already in place.

This is not, for the most part, a task for the software developer or producer.

A separate team or teams must be created for this purpose.

Again, processes must be adapted to the specificity of the region, country culture, and time zone.

Physical evidence

The reference base of customers using Open RAN is currently small.

It grows slowly.

You can follow such lists on the TIP website or the Open RAN Forum.

This does not change the fact that with a large number of potential suppliers, the “Place” strength of the individual suppliers’ offer is weak.

Of course, this is largely a matter of the lack of a large and “rich” sales network.

Another aspect of Physical Evidence is a matter of recognition and visibility of the Open RAN Producer’s brand.

The supplier must appear where there are customers and the operator’s employees.

International conferences, exhibitions (MWC Barcelona, Shanghai, Las Vegas), LinkedIn, and other important places on the Internet.

It is also worth reaching out to local regulators.

In some countries, government agencies still influence the admission of a product to the market (certification, approval).

Summary of the 7Ps

The biggest mistake of a manufacturer would be to think that his role ends when the technology is created.

I assume the producers don’t think so.

The 7P analysis complements the AS-IS analysis by showing additional aspects of the offer’s needs.

I encourage you to make your assessment on the web if Open RAN producers are reading this.

Maybe it’s time to take a closer look at the importance of the share of individual elements of the offer over time.

I did it in a fairly general gradation of the customer’s product life cycle.

The life cycle of the Open RAN product and related processes.

I compared the most important elements of the product life process (broadly understood based on 7P) from Single RAN, Open RAN, and Open RAN suppliers supported by the services of an integration company.

I added integrator companies because I believe that Open RAN vendors should build their product strategy for the future in cooperation with integrators.

But let’s first look at the figure below.

Figure legend:

- White fields symbolize the gap (GAP) concerning the reference provider in this case Single RAN.

- The lighter the green color, the weaker the performance of a given area.

- The purple color shows the integrator’s operating area.

- The red color shows the problem of the customer’s influence on the solution.

This is a great, in my immodest opinion 😉, comparison of differences in the offer, or rather in the ability to handle processes.

I compared 4 different solutions in the chart.

- Single RAN Provider

- A small Open RAN provider focusing on a certain specialization E.g. RIC.

- A large Open RAN provider with ambitions to fight for the MNO operator market.

- Open RAN supplier from point C together with an integration and maintenance company.

The following vendor map, created by Mavenir, will help you understand the difference between a small and large Open RAN vendor.

NetworkDesign

In this respect, Open RAN providers should better or worse cope with the operator’s needs.

A small provider will not be able to handle the full network architecture, but a larger provider will be able to handle it.

An integrator can fill a gap in the area of radio planning, which requires practical experience.

This stage of the process will take the supplier between 3 and 9 months. This is a relatively short period and takes up specific engineering and planning resources.

Such a date would be ideal.

Today we see that in reality, it is different.

The difficulty comes when the operator chooses different O-RU and O-DU/O-CU providers.

From the press notes, I conclude that this happened in the case of the 1&1 project in Germany or Vodafone in the UK.

Over time, this period will become shorter.

NetworkBuild

This is the first difficult area for a new supplier.

Civil Works (CW), rollout, optimization, and Project Management Organization (PMO) services go beyond the R&D area.

At the beginning of its activity, the supplier does not have to develop such services in his organization.

Over time, when he becomes a big player, like some of the singles, he has to develop this area.

Secondly, why change core competencies and move away from technology development?

Additional processes are necessary, but this can be circumvented, as seen in case 4 with an integrator partner.

The most important thing is to understand that an Open RAN supplier, when participating in a tender with an MNO operator, must include these areas in its offer.

It must be competitive in this area.

The specificity of the Open RAN architecture also requires a change in the implementation method.

O-DU takes on an important role in the network architecture.

The entire rollout, depending on the type of project (GF, BF), may take up to several years.

This is a great burden for the supplier.

Dedicated teams locally and at headquarters.

In the meantime, the network management process also takes place at this stage, because the first part of the network begins to live with a new pulse.

Manage the Network

If you manage to sell the product, it will take a few years.

But, it’s a new beginning.

Network management processes are the biggest test for a supplier.

This is where you will find out how stable and reliable the product is.

We will also find out how effective the upgrades are and whether they will cause a crash after changing the software.

In my experience, only one Single RAN provider has handled this impeccably. The rest were always tripping over their own mistakes in the new systems.

For everything to play like a well-tuned piano, organization is needed.

We are talking about O&M customer support processes.

Unless we reach the phase of operation of AIOps systems (AI DevOps), most of the tasks will have to be performed by the supplier’s employees.

The more customers we have, the more engineers need to support the processes.

And, the more countries and continents we serve, the more time and cultural zones we need to cover.

The more operators, the more individual needs and discrepancies in the main software version.

Matters become more and more complicated over time and increase costs.

This stage is a marriage for years.

Do you see how this is starting to move away from the very origins of the creation of the wonderful Open RAN producer?

After all these years, nothing reminds us of the great “garage” times.

Most topics in the company will fall into operational areas.

You have to take this into account and remember that ultimately this is the essence of your Open RAN product.

As a side note, I would like to add that the SCF manufacturer has a similar problem.

Instead of summarizing the analysis, I suggest going straight to the area of product strategy planning.

How do MNOs choose suppliers?

To prepare a product strategy, it is worth understanding how operators choose manufacturers.

Of course, we are talking about a general model, because each operator has its specific requirements.

Nevertheless, from my experience in various projects around the world, the general process is similar.

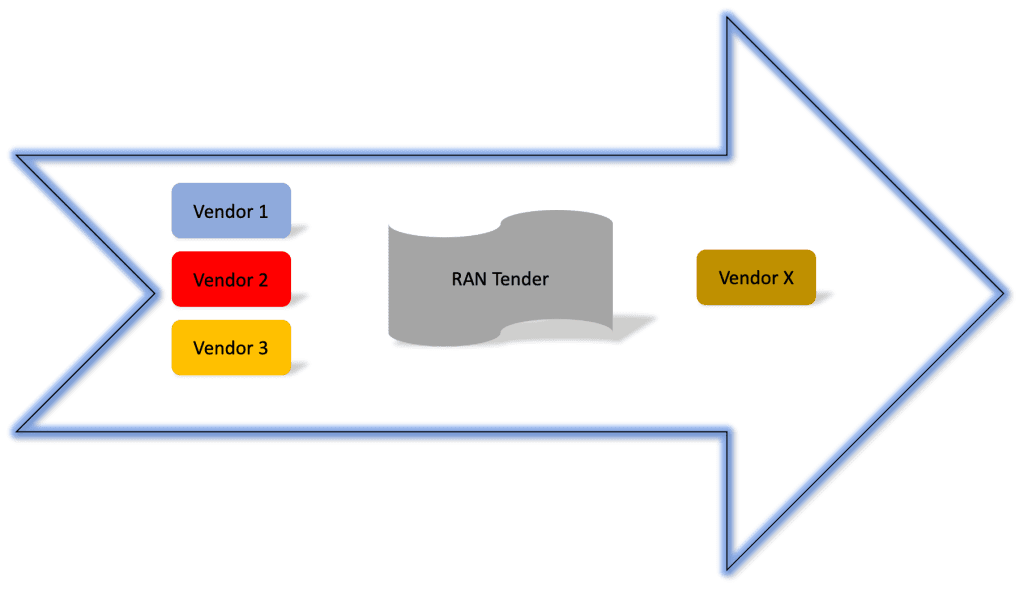

The case of Green Field. New network, new supplier

The process of selecting a supplier is quite simple.

However, there is a small problem.

Today, the case of Green Field among operators is quite rare.

In recent years, several GF projects have been launched based on the Open RAN Product.

Rakuten Mobile in Japan, Jio in India, or 1&1 in Germany.

However, we cannot expect much more of this type of event.

The exception, however, is private networks, which, according to analysts’ predictions, will be created in hundreds, if not thousands, over the next few years.

A private network is also a cellular network, but its scale is several orders of magnitude smaller.

An MNO operator has 1,000 or maybe even 10,000 base stations.

The private operator from 3 to 30 base stations?

Not on this scale, but I still highly recommend Open RAN providers to take part in tenders for private networks.

It is a great testing ground for the product and processes.

The real market is that of existing MNOs.

There are huge numbers of base stations for sale.

There is real money there.

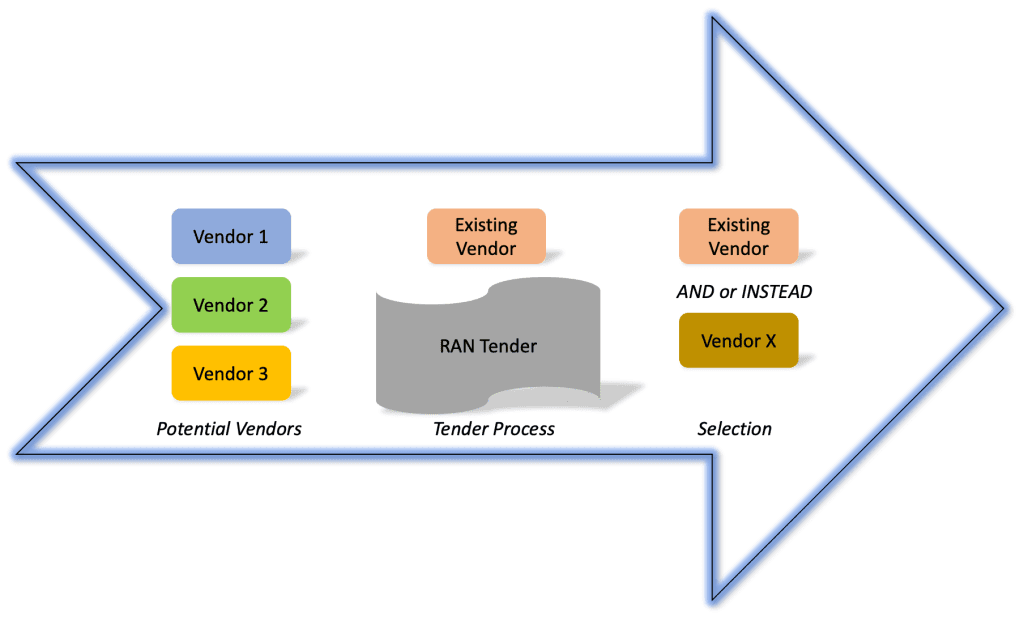

The case of Brown Field. Replacing a supplier or introducing a new supplier.

Potentially, the entire operator base, around the world, will sooner or later be looking at replacing or expanding their supplier base.

The process is much more competitive.

The basic difference is that we will be competing not only with new but also with existing suppliers.

It’s not just about the “quantities” of competitors.

It’s about competing on all aspects of the product, from a 7P perspective.

The client knows the existing supplier inside and out.

He knows its advantages and disadvantages.

It is comforting that he is opening the tender because something is not working in the existing cooperation.

However, during the tender, it is not known whether this is a big enough obstacle to take its place or – even worse – become another supplier.

In such a process, the new supplier must bring much more than the currently operational supplier.

The costs of entering such a process may not be lower either.

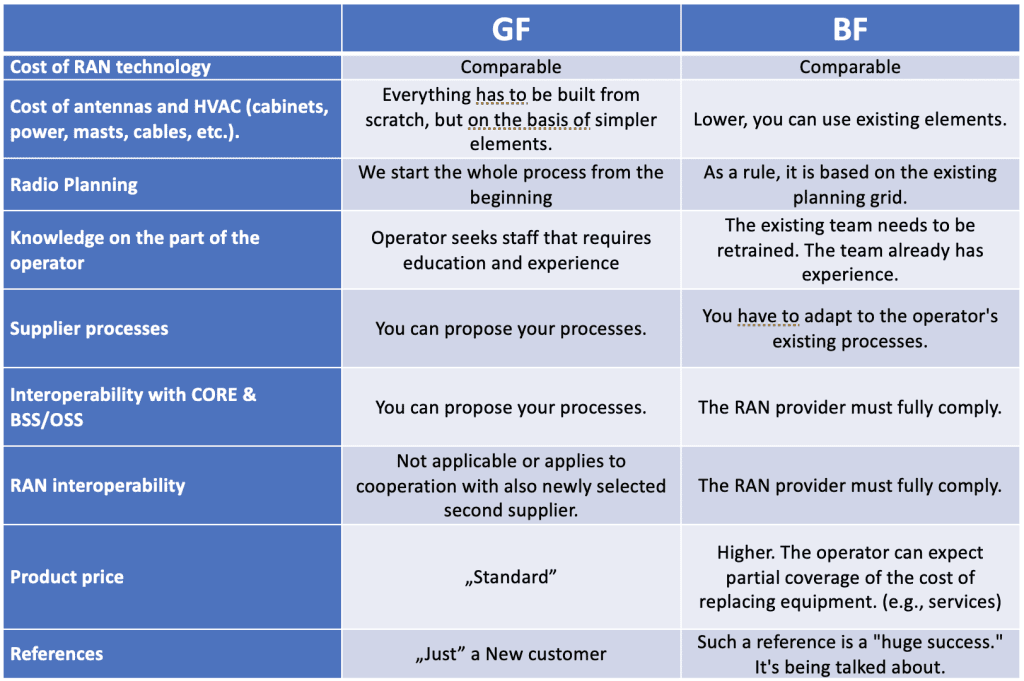

Let’s compare the advantages and disadvantages of choosing a supplier in both GF and BF processes.

This simple comparison shows that there are many more challenges ahead for an Open RAN provider.

It’s mainly about adapting to the operator’s existing suppliers and processes.

This significantly makes it difficult for a new supplier to build its technological and process identity.

Unfortunately, everything involves higher costs, which negatively affects the competitiveness of the offer.

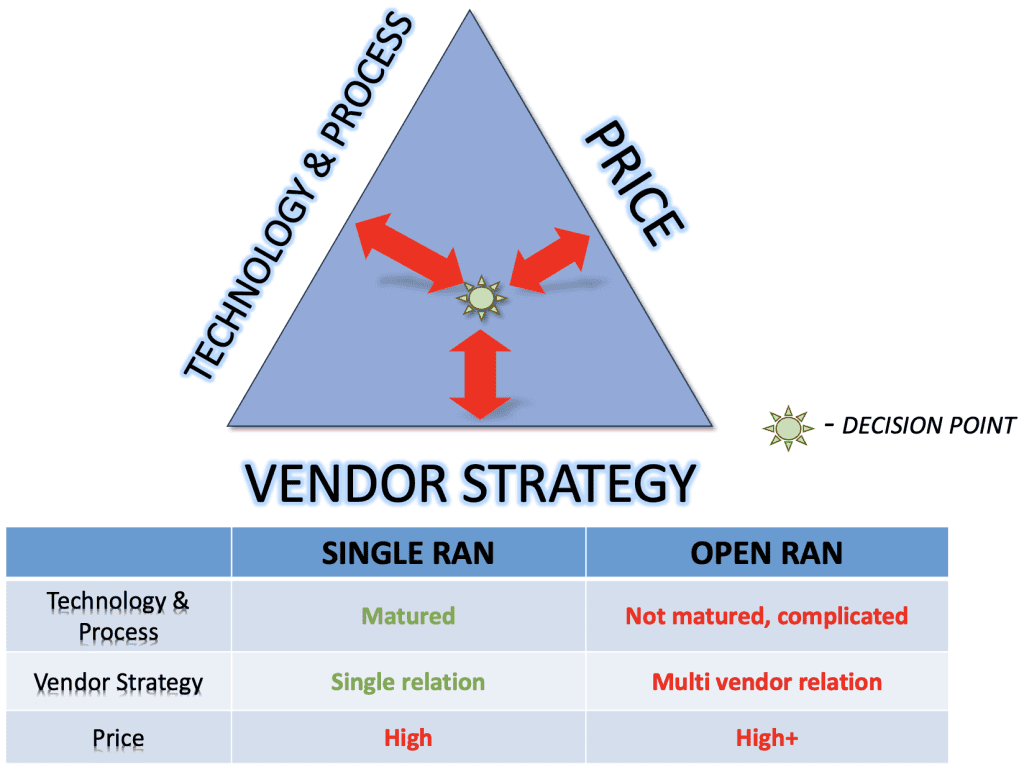

Operator’s decision triangle. Supplier selection.

Each operator has their own process and their own secrets when it comes to this matter.

Many years ago, I simplified the process as I saw it, based on the decision triangle.

In short, the decision is the result of the analysis:

- Technology and processes

- Prices

- Supplier strategy.

What percentage of decisions and what weight prevails in a given company is the operator’s secret.

However, I would summarize that all three sides of the triangle are important.

At the sales stage, an Open RAN provider must operate in all three areas.

You need to understand who is the decision-maker in the company, who is the influencer and who is the brakeman.

I won’t go into details, but as I mentioned in the 7P analysis, an efficient sales team is critical in this case.

Why am I writing about this triangle?

To emphasize once again that the Open RAN Product offer must be complete across the entire 7P area.

Sample strategy for an Open RAN product

The product strategy should consist of several elements:

- Product strategy

- Pricing strategy

- Promotion strategy

- Distribution strategy

- Implementation schedule and

- Budget.

In my SAMPLE strategy, I focused on only a few elements that are important in this analysis.

I only present the 7P product strategy and share a few comments in the area of product pricing and promotion.

I will present the strategy for the Open RAN Product in the table below.

Before you look at the offer, please remember that an advantage is built by preparing a good strategy.

Each supplier and operator in the Open RAN Product area must find its own way and its own way to gain customers.

Sample Open RAN product strategy based on 7Ps

I have prepared a sample proposal of seven general strategic recommendations, divided into 7P areas.

List of proposed strategic actions.

I’ve described all 7 ideas below.

1. Selection of integrators (local rather than just global).

An Open RAN provider does not have to create teams in its organization that specialize in delivering and Managing processes. This role can be fulfilled by an integrator. Several global companies on the market have prepared processes and even helped develop the product. I will mention, for example, HCL, Capgemini, Accenture, etc.

From experience, I would suggest that the integrator build a team based on local employees and partners.

For example, the specific functioning of the market in Poland may be difficult for experts from India.

To achieve operational and cost efficiency, these small local aspects can be an unbearable burden at the level of remote process management.

The advantage of this approach is the ability to focus on technology development and maintaining core competencies. The integrator can provide and train both supplier and operator staff. The integrator can also help with integration tests in the area of Open RAN, as well as integration with the operator’s CORE or OSS/BSS systems.

The disadvantage, of course, is giving away a large part of the income from the sale of the product.

As I mentioned earlier, the supplier can, of course, include these competencies in its organization as it develops. I reveal how large a percentage of the total cost it may be at the end of the article.

2. Open RAN company consolidations. Strengthening R&D, IOT, and budgets.

Ultimately, the market will not be able to “feed” several dozen RAN providers. The process of smaller companies merging is inevitable.

That moment will come when Open RAN vendors finally start getting serious projects. Strengthening the product together will work to everyone’s advantage.

Some smaller, niche suppliers are of course secretly counting on such a solution.

A few connections have already happened.

Thinking broadly, every player in this market should have strategies in this area.

A larger supplier has a greater chance of winning contracts, can expand its customer base faster, and can more fully cover the scope of the product delivery process.

3. Expansion of automation in the area of O&M processes.

In a long-term network management process, costs quickly become a heavy burden.

For the supplier and of course for the operator.

I am a supporter of automating O&M processes, for example through the AIOps methodology.

Some suppliers I talked to didn’t care about this.

This is definitely a mistake.

Rakuten understood this best by building a powerful set of tools in its Symphony product.

There are many repetitive processes whose automation can help improve quality and reduce costs.

I will give just one example. Automatic detection of the source of failure in a large area of the network allows you to immediately isolate the problem from additional, indirect effects. The failure of one router, resulting in the unavailability of 30-50 base stations, can be quickly detected and resolved.

The advantages include lower costs, which means also the value of the product. Less staff tediously poring over minor issues.

Simplifying processes. Once developed, the problem of detecting the source of problems always works.

And one more advantage. This approach is consistent with IT products from the IT market. Already proven solutions can be used.

Automation is one of the strongest points of the RIC product. Promotional strategies can be based on this.

4. Staff: cooperation with universities – RIC and algorithms

I haven’t written much about the power of the RIC platform, but I will write about it now.

By definition, this is a fantastic technological advantage.

In practice, however, someone must have unusual abilities to create very complex and efficient algorithms.

On the one hand, after some time, it will be possible to use products already created on the market (ORAN, TIP, ONF, etc.).

On the other hand, you can create your own R&D teams.

What’s my idea?

Cooperation with research centers. Universities, private companies.

The local operator may not receive adequate support from the supplier.

The operator is also unlikely to want to develop this competence within his scope.

The local university, however, may be happy to participate in such a process.

This idea is good for both the supplier and the operator.

5. Learning and creating processes based on private networks – fighting for contracts

I have already mentioned that Open RAN providers should participate in tenders for small private networks.

The entry barrier in the GF model is much lower than in the case of a large MNO.

It is worth building consortiums with other cooperators, but.

Please remember that the customer wants a complete solution.

Building a small private network with 10 base stations with two different O&M management systems is not a good idea. It is an effect of taking two types of O-RU, both from different manufacturers. The customer will refuse to maintain such a solution.

6. Building a reference network of operators

Green Field tenders make it easier to propose 5G and 4G solutions.

As an added value, I recommend promoting the advantages of the RIC solution and assisting in adapting individual algorithms from the beginning.

The more proficient a supplier becomes at winning small private network tenders, the easier it will be to build strength for large tenders.

For now, Single RAN providers are leading among private network providers…

7. BF: Move away from direct comparison with Single RAN. Show the advantages of RIC and increasing efficiency through algorithms.

I have already mentioned that entering into a tender with a Single RAN supplier only based on the advantages of base stations is a poor solution.

As an added value, I recommend promoting the advantages of the RIC solution and adapting optimal algorithms from the beginning.

The problem today, however, is the lack of actual references proving the advantage of RIC over no RIC.

I hope that the environment will eliminate this issue in the coming years.

The strategy of focusing only on the radio product is practically doomed to failure.

Single RAN providers have much more refined products in this area.

The strength of Open RAN is its algorithm optimizations.

I presented some ideas that can be enriched accordingly.

The above ideas for expanding the product range are something that many suppliers lack.

There is one more important area that I would like to touch upon when it comes to product strategy.

Price of Open RAN products. Interesting observations

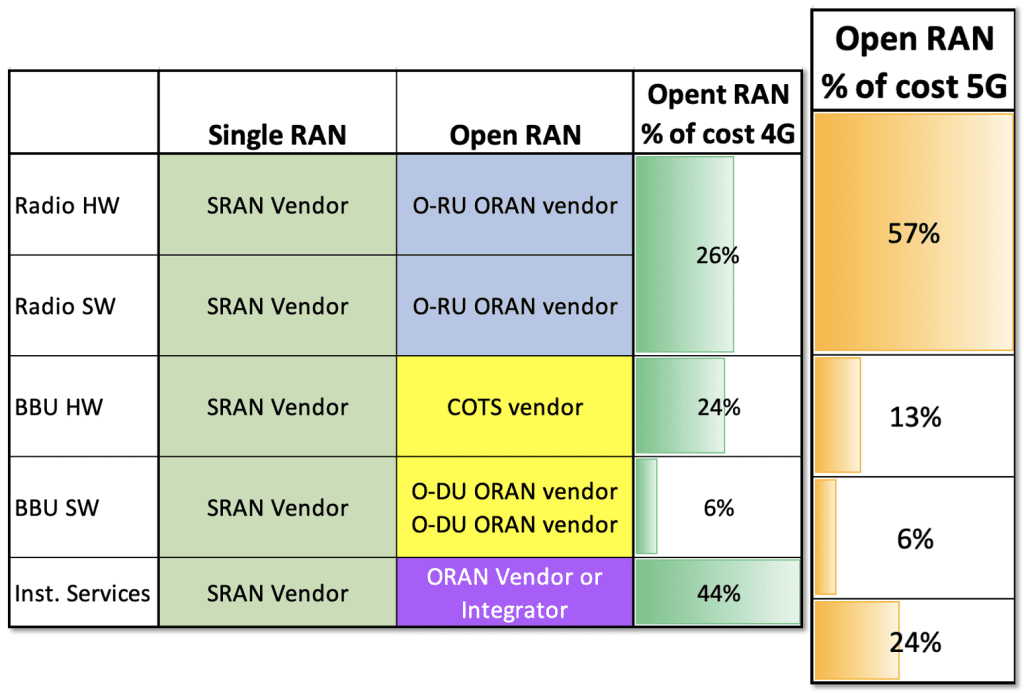

I’ll start by illustrating the revenue split between Single RAN vendor and Open RAN vendor(s) in the RAN space.

It wasn’t until I drew this that I realized that not every small supplier could have a place in this game.

Open RAN hardware costs

The first two columns show the difference in the profit sharing of the Open RAN Product.

The Single RAN provider wins the entire pot.

It has its hardware, its software, and its own services and service teams.

For Open RAN providers, the cost breakdown is different.

The manufacturer of O-RU devices, i.e. HW radio, earns the most (case without services).

This will probably always be the case because it is the most complicated part of the product.

More and more advanced 5G solutions such as Massive MIMO 32T32R will increase this disproportion.

This is visible in the comparison between a 4G and a 5G station.

In second place is the supplier of server equipment.

Similarly, the more complex the base station configuration (number of bands, multi-path antennas), the more efficient the server will be needed.

In third place, unfortunately with the lowest profit, is the software manufacturer O-DU and O-CU.

Here we have probably reached the heart of the problem in terms of competitiveness concerning Single RAN.

The Open RAN manufacturer must spend a large budget on R&D, and integration with newer O-RU versions, and it will not win tenders on its own.

This is proof that merging companies is inevitable.

Of course, you can make money by optimizing RIC algorithms, which is why I insist that RIC is the best hope for the development of Open RAN providers.

Open RAN Services

In the above comparison, I also added the costs of services expected by the customer.

In this real comparison, you can see that it is a large part of the income.

I have already written several times that services can be provided by your organization or with the help of an integrator.

So what to do with the costs of the Open RAN Product

I did not take into account many other factors in this comparison.

Don’t take this as a complete comparison.

I wanted to show that sooner or later companies have to consolidate if they want to fight for big contracts and money.

As an example, we can cite the two largest companies today.

Rakuten, building product advantage in software agility and automation. It provides a full solution for the client but is based on O-RU partners.

Rakuten improves its business plan through sales volume.

They installed most O-RUs in their network. Profit margins remained within the scope of my own business.

The second example is Mavenir.

Like Rakuten, Mavenir wants to ship everything but is also reportedly working on producing its own O-RU devices.

It seems they want to become independent from cost-sharing with OEM/ODM manufacturers.

There is another big difference between these two already great competitors.

Mavenir is not an operator, it is only a provider.

It cannot build a large reference network from which to learn and grow.

Rakuten has built probably the largest Open RAN 4G and 5G network in-house today.

Ericsson’s announcement in the industrialization of the Open RAN Market 2024

In September 2023, Ericsson announced its intention to participate in the industrialization of the Open RAN market from 2024.

Based on the one million eCPRI-equipped radio modules already sold, they want to open up the possibility for other Open RAN providers to collaborate.

Do you feel this amazing turnaround from Ericsson?

What does Ericsson gain?

Firstly, it gives customers an important message. Leave Our Radio devices, even if you want to change your algorithm provider, introduce RICs, etc.

You can see from the previous chapter how big the money is. It allows customers to save a lot.

And Ericsson? Ericsson will keep its market share because it will still rake in the most money.

Secondly, look at how much it increases the barrier to entry for other Open RAN providers, especially OEMs and ODMs.

On top of that, Ericsson will have the opportunity to influence the roadmaps of Open RAN vendors, because O-RU is a big part of the technology value.

Smart move.

And I put forward the thesis that the same move is being prepared by Huawei.

For the time being, Ericsson has made a pre-emptive move.

Ericson has announced the implementation of two other important elements to its Open RAN strategy.

A standard cloudification solution and a management system for different Open RAN platforms.

Can you see the idea?

Ericsson wants to take smaller Open RAN providers under its wing.

Ambitious, but will they succeed?

The end of 2024 will show.

Instead of a summary

I like writing such analyses.

Very interesting conclusions can be drawn.

I haven’t found a similar analysis so far, and I think it’s worth considering what’s next for the Open RAN product.

Many companies have great ideas and ambitions.

However, before the idea becomes a product and wonderful sales occur, you need to prepare your strategy.

I invite you to discuss if you have other opinions and observations.

I wish all Open RAN Product suppliers good luck and perseverance in the fight for success.