The Polish5G memorandum signed in October 2019 gave rise to something new. There is a chance to expand the world of private mobile telecommunications networks with the National Operator.

I honestly admit that it is difficult to refer to this initiative without knowing the content of the memorandum, let alone the goals that the parties set for themselves. According to laconic announcements, the MoU (Memorandum Of Understanding) initiative is the analysis of the concept of establishing one wholesale operator of a nationwide wireless mobile communications network in the 5G standard, operating in the 700 MHz bands. The consortium consists of Polish Development Fund, Exatel, Orange, Polkomtel, and T-Mobile. Operator Play was present at the signing of the MoU but did not formally join the consortium.

Memorandum was signed at the headquarters of the Ministry of Digitization is to help in eliminating “range holes” in various parts of the country. It is also intended to help ensure communication for the Polish Armed Forces, uniformed services, rescue services, and critical infrastructure. The existing telecommunications infrastructure is to be used to build a nationwide 5G network. Commercial and public operators are considered, according to the president of the Polish Development Fund, Paweł Borys.

The Treasury is to propose a single operator for the entire network. At the same time, the signed memorandum prohibits the provision of commercial services, competitive to the currently available commercial services of mobile operators. Work on the feasibility study for this project is to be completed in December 2019.

I will try to quickly analyze (thinking simply and directly) what are the opportunities and threats ahead of the consortium, from the perspective of the Polish5G operator.

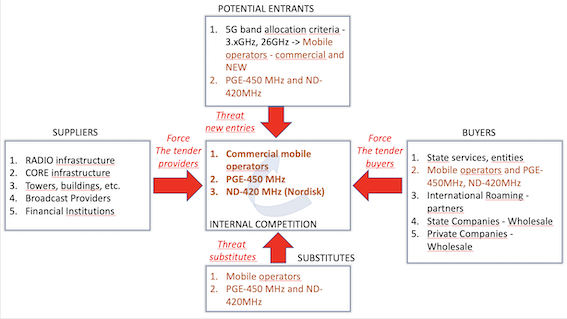

Porter’s Five Forces analysis for the Polish 5G solution

To begin with, I will look at the environment in which the new operator must operate. For the purposes of the analysis, let’s call it Polish5G.

In Fig. 1 I have included the forces from the surroundings of the new operator.

Internal competition – the first force

Polish5G will not be a new player on the market. Private mobile infrastructure operators – Orange, Play, Polkomtel, T-Mobile, virtual operators – e.g. Virgin and many others, as well as CDMA Nordisk (ND-420) in the 420 MHz bands and the emerging national LTE operator in the band already operate on it today. 450MHz built by PGE/Inea (PGE-450). You can also add an operator dedicated to PKP railway networks, i.e. GSM-R (PKP-GSM-R).

Therefore, there are many potential competitors, partially fully competing with Polish5G, such as commercial operators, but also half-competing ND-420, which still has the ambition to sell an offer for uniformed services and state-owned companies. For some time now, together with its shareholder, Polkomtel, it has been conducting LTE connectivity tests.

Substitutes – the second force

It is probably no surprise to anyone that the services to be offered by Polish5G can be easily offered by commercial operators today. They do not have a strong need to cooperate with Polish5G, assuming, of course, that they will buy a band for the 5G network. The issue of covering the entire country with 5G network coverage in the 3.XGHz and 26GHz bands is not possible in practice (not profitable). Where there are customers, i.e. in agglomerations and cities, welding is relatively simple, having a network of locations. Withdrawal from the consortium of commercial operators may mean a huge problem for Polish5G, even a small chance of success. This strength is in favor of commercial operators rather than Polish5G, after all, the memorandum is not an obligatory contract.

Potential entrants – the third force

This power is the most uncertain name for all players because the future of the 5G and Polish5G networks depends on it.

Probably Polish5G will be created as a government initiative, and it will allocate the 700MHz band without a tender, just like it was with the 450MHz band. As a consequence, a very important question will arise, what will the process of selling the license for the 3.XGHz and 26GHz bands look like in terms of obtaining the State Treasury’s revenue for this good.

In the event of an open tender/auction, UKE may allow a new player to play (as of today, a scenario not assumed in the consultation process), not necessarily existing mobile operators. This scenario happened in the case of auctions for 5G bands in Germany. The temptation of such a game can be huge because the financial results surprised the German government, they were phenomenally high. Billions of EUR to the government coffers. Is such a case possible in Poland?

I cannot rule it out looking at the 800MHz band auction from years ago. The new third force can absolutely shuffle the cards in the market. A new player may be someone who is absolutely outside the group of current Polish operators, e.g. large foreign operators (I will not mention anyone on purpose, to avoid speculation). They can also be domestic companies, i.e. players who have already attempted auctions/tenders in the past.

Buyers – the fourth force

The assumption of the Polish5G network is to offer services to state entities, uniformed services, and wholesale settlements for traffic with other operators.

Public clients are a well-defined target group, but I am not sure if they are richly paying clients. As a rule, in state offices and services, there is strict control of expenses. A large part of the revenues of mobile operators is expensive subscriptions, expensive phones, foreign calls, value-added services (premium SMS, Video packages, additional service packages), and finally international roaming. A state-owned client is rather an economic sector than a premium sector. Let’s add to this the assumption of higher security rigor, which entails additional costs for the purchase of specialized equipment, transmission, and maintenance services.

One of the assumptions of the Memorandum, as we read, assumes that the Polish5G operator will not be able to offer services to mass clients on terms better than the competition (good principle of market competition). On the other hand, Polish5G is to offer/receive traffic from mobile operators in wholesale settlements, i.e. at rates lower than those offered to end customers.

Considering the fact that commercial operators will launch their 5G networks in agglomerations and cities anyway, it is easy to realize that Polish5G will only handle traffic in less urbanized areas, i.e. where there is no chance for high revenues. Subscribers of the #Polskie 5G network will have to use wholesale networks of mobile operators to have access to 2G, 3G, 4G, and 5G networks in other bands (coverage in the interior, access to high-speed internet with high-speed – the same 700MHz band does not provide ). It is therefore impossible to balance the movement between these entities.

There is one more question in this model. What is the role of commercial operators in building the network and maintaining the network? How # Polske5G will be charged for these services and construction and how it will earn for these costs? Partners, mainly commercial operators, have more and more revenue advantages.

Suppliers – the fifth force

This strength, depending on the state’s policy level arrangements, may affect the cost side of Polish5G.

For some time now, there’s been a loud message from the American authorities that 5G networks should be technology-free from China.

The Polish authorities have not commented on whether they intend to limit access to the construction of the 5G network in Poland to any entity. From a price negotiation perspective, fewer suppliers mean more difficult talks and, consequently, higher infrastructure costs. It’s no secret that Chinese companies are among the best providers of mobile radio networks on the market today, and looking at the 5G patent market, they are the dominant player.

The elimination of such suppliers means no access to the most advanced technologies, and besides, license fees will be required for Chinese companies for patents that are used by other suppliers from Europe or the USA. In a word, a skin for a layette. (Here I would like to add that many of the components for the hardware and software of companies from the USA and Europe are produced in China or India. It would, therefore, require clarification, which means equipment approved for use in Europe or the USA.) techniques used to build a network:

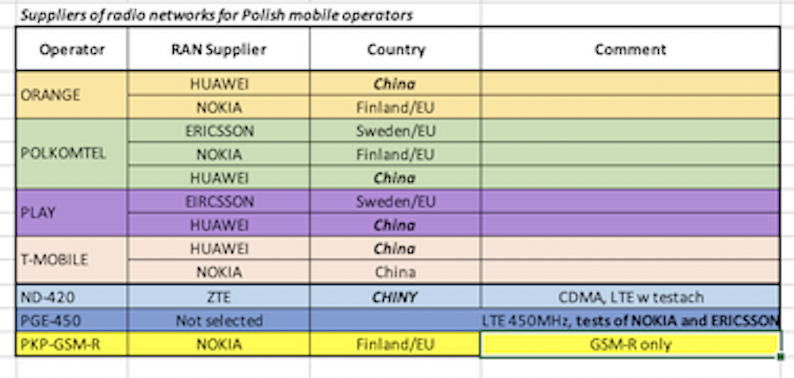

1. RADIO infrastructure

The situation with limiting access to equipment from China is not so obvious, because currently, commercial mobile operators use such solutions on a mass scale (Fig. 2.).

There is another very interesting aspect of the analysis of 5G network suppliers, i.e. Polish suppliers like IS-Wireless. Changing the entire philosophy of building the CORE 5G network and changing the approach to the RAN network will allow smaller suppliers from the ICT sector with telecommunications roots to exist in the near future. What until recently was the domain of only a few suppliers in the world, now can be designed and produced even by small Polish companies. Thanks to the technique of virtual environments on standard servers, it is enough to create appropriate software that fulfills the w.g. of the 5G SA standard (Article).

Moreover, the O-RAN standard, based on the 3GPP specification, allows the creation of a lower-order SD-RAN radio network (pico level and small cells; i.e. indoor coverage of commercial or sports spaces) in Polish companies.

NCBiR is already co-financing the development of the first prototypes of 5G devices and software.

2. CORE infrastructure

Here, the situation is similar to that of the radio network, but the scale of costs incurred and the impact on the entire infrastructure, due to the smaller amount of this type of equipment, is lower.

3. Towers, buildings, etc.

The ability to quickly build a network, in the current conditions in Poland, is very limited due to: PEM power limits, the long process of obtaining building permits, protests of residents, limitations in the possibility of construction due to land development plans, large competition in the construction of the network, i.e. access to specialized subcontractors (currently: PGE-450, PKP-GSM-R, the PLAY nationwide network are under construction, the networks of other operators are being expanded; in the future, these companies will absorb the construction of a 5G network for mobile operators after the tender for the 3.XGHz and 26GHz bands are concluded ).

In such a situation, Polish5G will have to lease towers from other operators. In the financial results, this is a pure cost that burden the financial activity of the company. To afford such a model, you simply need to have a large budget and, in the later stage of development, income that will balance these costs.

4. Broadcast providers

Like the tower vendors. It is also a cost, and as a rule, transmission can only be provided by a few operators to the towers placed in the middle of nowhere, making it difficult to negotiate good prices.

5. Financial Institutions

The last element of this force is financial institutions. If the Business Plan for this venture is difficult, then of course money will be expensive. Of course, there is a State investor in the consortium – the Polish Development Fund. Probably part of the infrastructure costs will be covered by the state budget. However, I do not know if the state budget is prepared for multi-billion investments. For example, the construction of a dedicated PGE-450 network, according to press reports, is expected to consume about PLN 2 billion to operate the power networks, and this is a network that requires fewer towers throughout the country than a network based on the 700 MHz bands.

Summary of Porter’s Five Forces

Summarizing the forces that will act on the new operator, Polish5G, it can be noted that its future in four areas depends mainly on what conditions will be set by mobile operators (Fig. 2). Therefore, I am not surprised that the consortium invited major mobile infrastructure operators to sign the Memorandum.

Memorandum partners give themselves a chance to find a positive Business Plan by the end of this year,

I will also look at the SWOT analysis of this project, I will try to find opportunities and main threats for Polish5G.

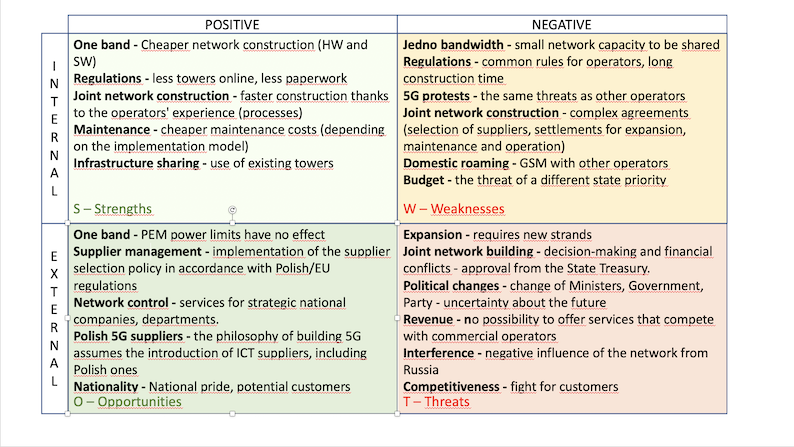

SWOT analysis

Based on what is known today, I made a simple SWOT analysis (Strengths, Weaknesses, Opportunities, and Threats) in order to outline a strategy for the Polish5G operator.

Figure 3. SWOT for Polish5G.

S – Strengths

Building a network with one band towers not necessarily put up as four “clones”, with less radio equipment (Hardware HW and Software SW – licenses) will be much cheaper – TCO. If part of the locations (towers) can be leased from existing operators, the network can be built faster.

The fact that the Government indicated a single network operator is interesting. Maintaining the network, assuming that one supplier of radio equipment will be selected, should be simpler (spare parts, uniformity of functions, upgrades, updates).

The remaining aspects of construction, maintenance, and development will depend on the choice of the model of cooperation with commercial operators.

O – Opportunities

The implementation of one 700MHz band on new towers should not cause problems due to PEM limits. It will be completely different in the case of “proving” a 700MHz installation on structures where other devices already exist. PEM limits require that all antennas on all bands be taken into account.

The single national operator model will allow the selection of a radio supplier compliant with the safety guidelines. Of course, we are talking about objections to suppliers from China. In this model, you can freely influence the choice of partners. In addition to the selection of the supplier, you can of course also plan the network from the beginning so that it meets the requirements of special recipients such as Uniformed Services, state institutions, or strategic partners.

Getting through, a very important opportunity is to put on the newly emerging Polish providers of mobile network infrastructure: SD-RAN based on the O-RAN standard, MEC servers in a virtual environment, or finally the CORE 5G SA backbone network. The 5G philosophy is more than just duplicating the 4G / LTE technical scheme. It is a change of architecture and the introduction of the methodology of the functions of mobile network elements as software running on standard servers.

The last issue is the “National Duma”, that is, an area on the border of PR, which cannot be overestimated. This is not a technical aspect, but definitely not insignificant for a large part of Poles, as can be seen in recent years. It is possible that this will be an argument when choosing a mobile operator, who knows?

W – Weaknesses

One strand, on the one hand, an advantage, on the other hand, a great disadvantage. The limited bandwidth (initially 2x30MHz), geographically limited until the end of 2022 due to interference from TV in Russia, will not provide a large capacity to reconcile all recipients. This is a typical coverage band, which means it will not enable the construction of “substantial” data packages for subscribers replacing fixed-line operators. So again we have a factor limiting potential revenues.

The process of construction, obtaining permits and carrying out PEM tests, all will be the same limitation for Polish5G as for the existing operators. Sweat, tears, long lawsuits in local offices, and, in addition, user protests, because 5G is “evil” – of course it is just black PR (Scientific Shurism), but very “lively” and stimulating the imagination. Polish5G will join in this situation as another applicant, lobbying the authorities for mega-laws to facilitate the construction of the network.

As if the Polish5G network was not constructed, it will require many complex inter-operator agreements. Wholesale for sending traffic, wholesale for receiving traffic, Domestic Roaming contracts to accept traffic, but also Domestic Roaming to allow subscribers to use other networks. In addition, contracts for the lease of masts, other locations, transmission, maintenance, expansion, etc. In a word, legal thicket requires a large and efficient administration.

The matter may be complicated by the choice of the Model of Cooperation. One or more builders, one or more maintainers, and one or more RAN providers (see the last chapter).

The last real threat is the budget. WG the analysis that I saw in the Internet media talks about amounts reaching even a few up to ten billion PLN. What if, due to sudden changes in the priority of state expenditure, there is a shortage of funds, it is a deliberation, but until we know the Investment Plan, this weakness cannot be ignored.

T – Threats

What will happen when the Polish5G operator will gain an appetite for a larger network capacity in the future or wants to offer other services? It will queue for other bands (re-auctions from the returned band) or new bands. Competition for “limited” goods will increase.

With a complicated legal structure and a maze of contracts, it can be expected that in the future some partners will start to “fidget”. Considering that companies with Treasury shareholding require the approval of Ministers’ representatives, it is certain that the decision-making/approval process will delay some steps in the consortium’s activity. With the considerable link between the state business and private business, as we add to this the risk related to the changes of Ministers, Governments, and political parties, it becomes clear that strategically this is a weak relationship.

What, in my opinion, can most influence the low profitability of investments is the assumption of not competing with commercial operators with lower prices of services. A glass ceiling can prevent massive customer acquisition. It is hard for me to believe that the revenues will be balanced by state-owned companies, which I described earlier. The Polish5G operator can of course count on the “freshness” effect, which may give a chance to attract customers, as the beginnings of all new virtual operators showed, but based on the “lower prices” strategy.

Summing up the cursory SWOT analysis, it can be seen that the strategic opportunities for Polish5G are fragile. The strong competition that must become a partner but also remain a competitor (Competition). The main owner of the consortium, ie the State Treasury, setting the consortium “strategic” goals important to you, will not facilitate cooperation with private entities that have purely business goals set by the owners – that is, maximizing profits.

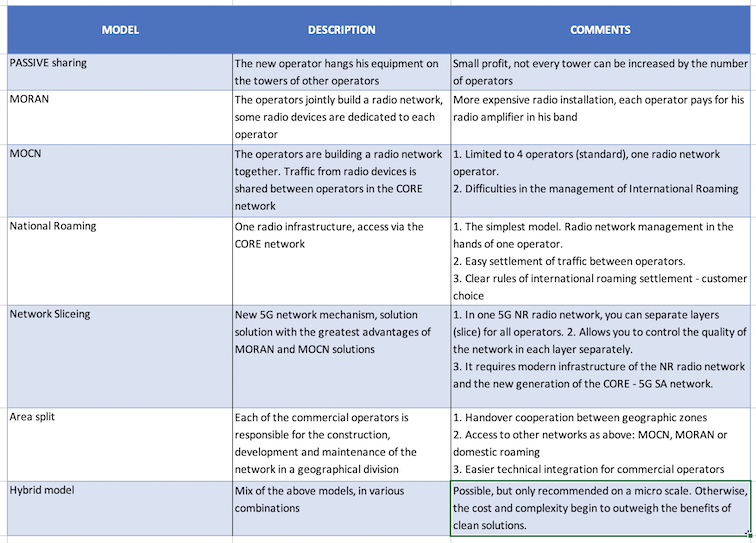

Cooperation models

At the end of the analysis, it is worth trying to verify in which model, from the point of view of technical possibilities, Polish5G could cooperate with other operators.

This is a very important issue because it directly translates into the ability to implement, but more importantly, it translates into the cost of the solution.

Figure 4. shows the basic 5 models, plus a geographically mixed model and an overall hybrid model.

Standard models (MORAN, MOCN, Domestic Roaming, and Network Slicing) result directly from the standard of 3GPP cellular systems and are practiced in the world, also in Poland, with great success. In the comments column, I have listed the main features of each application. The most accurate model for today is definitely the solution based on the Domestic Roaming agreement. The Polish5G operator would have to sign Domestic Roaming agreements (most likely bilateral) with all operators, which would allow wholesale services to be offered to all market players. Such a solution does not require complicated changes to the radio networks of the already existing infrastructure operators.

This table, taking into account the news related to the implementation of 5G technology, brings something new, something technically unique, which is possible only from the implementation of the 5G SA (5G CORE Stand Alone) technique, i.e. the Network Slicing function (network layer). The assumption of this technique was to divide the radio network and the CORE network between various telecommunications services, e.g. IoT, high-speed internet, and Industry 4.0. Each of the services has its own zone in the network, but more importantly, it can have its own quality parameters. However, there is nothing to prevent this mechanism from being used to allocate radio network resources between different operators.

Thanks to this, two possible scenarios have appeared since 5G, which will give light to the Polish5G wholesale venture: Domestic Roaming for today and Network Slicing for the near future.

Summary

The entire project is very interesting project from the management perspective. The attempt to reconcile the business goals of private cellular operators with the strategic goals of the state seems to be strongly contradictory.

As a cursory analysis shows, this is a very difficult business arrangement.

Someone will have to yield, someone will have to offer more, there are many conflicting goals and the space is limited.

The technique allows you to achieve the goal, but in this case, it’s not about technique. Here, the greater difficulty is in business arrangements.

I am sure that we will all look forward to the results of the analysis and the consortium’s decision.

Thank you for reading the article patiently, feel free to comment under the article. Your comments are a source of knowledge and inspiration for subsequent articles.

Andrzej Miłkowski (I also invite you to listen to broadcasts and audio interviews on the Podcast “Simple and directly about telecommunications”).